Debt, Inflation, Interest Rates, and the Markets

"The problem is very simple now: shortages of everything except money."

- Cover of Time, January 11, 1943

Hard to believe, but summer has come to an end, the days are getting shorter, and the kids are back in school. This summer has been somewhat quiet in the markets as the S&P 500 seems to be humming along and quietly making all time highs on an almost weekly basis. While there has been some sector rotation, the overall market has been drifting higher with very little in the way of volatility. Despite the positive market action and the lack of drawdowns in the market, there does seem to be a lot of fear.

Currently, the major fears in the market are the Federal Reserve raising interest rates and decreasing asset purchases, the reopening trade being slowed by COVID variants, as well as inflation and supply chain disruptions. The news media continues to push fear, uncertainty, and doubt and the conversations I have daily with clients and friends relay much of that fear. I will try and give you a level-headed summary of what I see going on in the market today and what to look out for going forward.

If you have listened to any financial pundits recently, much of the talk has been on economic recovery and how the Federal Reserve will respond. Federal Reserve policy makers have been keeping interest rates near zero and have been pumping the system full of liquidity (cash) via their asset buyback programs. This monetary policy has been a big driver of the stock market since the covid crash last March. While the market has been performing very well for the past 18 months since the bottom, there are still many “cracks” in the system and reasons for the Fed to be cautious in easing their policies. On September 3rd, the August jobs report was released and it was a shocker. Only 235,000 jobs were added despite the expectation of seeing upwards of 720,000 new jobs. The miss was largely blamed on service sector jobs slowing due to the delta variant. This type of economic data is making it tougher for Fed to justify tapering and tightening economic policy. Some members of the Federal Reserve have been calling for tightening by later this year into 1st quarter 2021. They will take a wait and see approach and we will be monitoring this closely.

Our economy is now largely driven by the monetary policy decisions at the Federal Reserve as well as fiscal policy decisions leveled by the US government. We now need to pay very close attention to what these governing bodies are doing as they are pivotal for our own personal financial well-being. On paper, they have done a very good job over the past several years, let’s see how:

- Stock Market all-time highs

- Home prices all-time highs

- Personal incomes all-time highs

- Job openings all-time highs

- US core inflation highest since 2008

Yet, despite all of these wonderful economic indicators, the Federal Reserve argues we need keep interest rates at zero for the extended future and keep buying bonds to boost asset prices and increase inflation. The Federal Reserve would prefer to see inflation run above target than below. The last time they “tapered” to reduce inflation it did not go well. In 2013 when Ben Bernanke eased up on monetary policy, we had a market correction colloquially known as the “taper tantrum” and the Fed was forced to reverse policy. Could we see a repeat of this action this fall? Perhaps in the short term, but with debt at record levels, a sustained reversal in interest rate policy is unlikely in our view.

Federal Reserve Objectives

The Federal Reserve describes their guiding principles behind their monetary policies as;

- Achieve maximum employment

- Moderate long-term interest rates

- Keep prices stable

- While these goals sound noble, they get a little fuzzy in practice. What is maximum employment? An appropriate definition might be: the situation where everyone looking for a job can find one in a reasonable amount of time. Right now, the unemployment rate is around 5.2%. That is a pretty solid number and one that would fulfill their objective. The labor shortage is real and many employers are finding it very hard to find workers.

- What about interest rates? A reasonable target for interest rates would be keeping rates low enough not to burden the private sector with debt they cannot service while making sure rates don’t get so low that a debt bubble is fueled (we may be there).

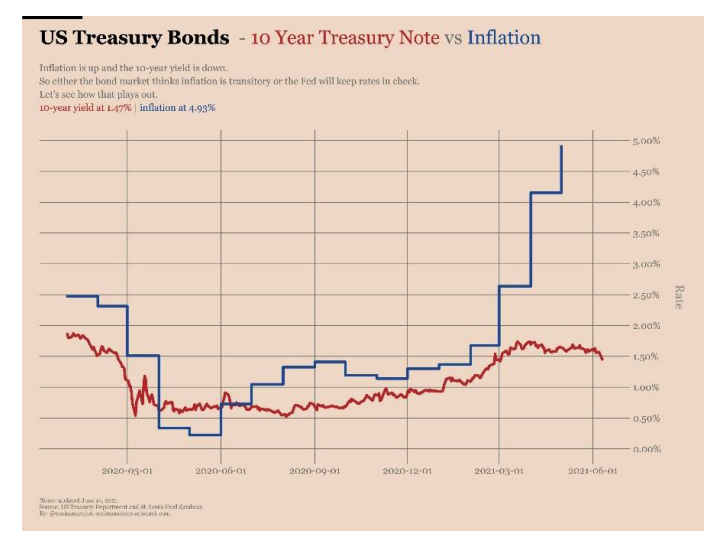

- Stable prices are the hallmark of a healthy economy. Stable prices allow for businesses to discount future cash flows and make decisions today with relative certainty that prices will be similar tomorrow. Right now we have anything but stable prices. The prices of shipping, raw materials, and labor have all skyrocketed well past the 2% annual increase the Federal Reserve likes to see. Below is a chart showing both the inflation rate as well as the rate of the 10-year treasury note. The 10-year treasury note is generally considered the “risk-free rate” and is the return you can expect to safely return on your cash. 1.4% is not much and has left investors looking for better return elsewhere. As you can see inflation has jumped up towards 5% leaving the “safe investment” with a real negative return.

Due to higher inflation and low returns in the fixed income market, investors have flocked to more speculative assets. Owning cash and bonds have become losing propositions. Right now, your cash positions are losing money at 5% a year, and much more if you plan on using that cash for healthcare, to purchase real estate, or buy almost any commodity. I’m sure many of you have noticed the increase in prices at the gas station and the grocery store. Inflation in consumer products is very difficult for people who have low fixed incomes and do not have many assets to begin with.

Debt

Even before the pandemic hit, the US government has been on a bi-partisan spending spree. Historically, the gold standard has acted as a check on government spending. The government’s balance of payments was moderated and naturally regulated by how much gold was in the vault. However, on August 15th, 1971 US President Richard Nixon announced the end of the dollar’s convertibility into gold and made the US Dollar strictly a “fiat” currency. This means that the US dollar is strictly backed by the “full faith and credit” of the US Government. Exactly 50 years after this departure from the Gold Standard, we witnessed a botched departure from Afghanistan, which has put the full faith and credibility in the US Government to the test. The reason I bring this up is because our economy and your portfolio is almost entirely denominated in US Dollars. A drop in the value of our currency means a drop in the value of your purchasing power.

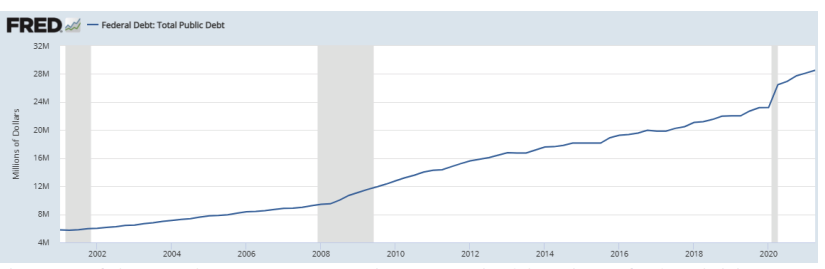

The value of our currency comes from not only our willingness to use it, but from foreign creditors willingness to accept it. With an ever-expanding deficit and debt, the ability for our government to pay it’s bills is starting to come into question. The current US Debt is just shy of $29 Trillion, much higher than the $6 trillion or so in 2001 before the attacks on 9-11. This chart shows our national debt over the last 20 years, it may seem gradual but pay attention to the numbers on the y-axis.

The current fight in Washington D.C. is again about raising the debt ceiling to fund our liabilities. Janet Yellen has warned that the US will run out of cash as early as October unless there is an agreement to raise the debt ceiling. Congress is also still working on a $1.5 trillion infrastructure bill as well as $3.5 trillion bill aimed to increase equity and sustainability. It remains questionable if these bills will pass and if they do, what they will look like.

So, what does all of this mean? Right now, the US deficit and debt are very high. If the US government is going to hold a lot of debt, they need to make sure the interest payment on that debt is affordable. In order to keep that interest payment in check, interest rates need to stay low. Inflation running above the Federal Reserve’s 2% mandate will also help the debt will be more manageable. High inflation is a good wat to “monetize” the debt. Servicing the debt via taxation is also easier when capital gains tax revenue is higher, meaning an inflated equities market means more tax revenue.

To me, this means interest rates should stay low, inflation will remain above average, and we should have higher than average stock market returns. There will always be reasons to worry and the media will no doubt make things seem worse than it really is.

I hope you had a great summer and look to forward to chatting soon!

Sincerely,

Bruce Carlson, CFP®

President

Carlson Asset Management

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.