Inflation, Shortages, and a Fed Stuck with a Tough Choice

“In the long run, inflation comes to an end with the breakdown of the currency.” -Ludwig Von Mises

It has been a wild ride in the stock market of late, and not in a good way. The NASDAQ is in bear market territory and the Dow Jones is down over 10%.i Bonds, which have historically been a safe haven in challenging markets have been anything but this year. The iShares Core U.S. Aggregate Bond ETF (AGG) is down 9.7% YTD making “risk off assets” much riskier than in years past. On top of a wild market, we have experienced interest rate increases, war in Ukraine, and surging inflation. Even if you are not invested in the markets, you have certainly felt the pinch of inflation and seen the shortages in the stores. So, what is going on? There are a lot of things happening all at once and it can all get very confusing. News sources today have become very bifurcated and everyone’s world view is shaped based on which sources they follow. This can make it difficult for me as your financial planner to give market commentaries as I want to be honest and provide accurate information. So, for this article I am going to try and give some reason to why the market has been struggling and what we can expect going forward.

The Federal Reserve

I have written extensively on Federal Reserve policy in past letters as it has arguably become the primary driver of market moves today. Since the pandemic crash in 2020, every Federal Reserve policy and meeting has been closely watched by Wall Street and market participants alike. This is because of the radical and unprecedented policy decisions made by the Central Bank in the past 2 years. The Federal Reserve balance sheet has more than doubled since March 0f 2020. In order to stave off a recession due to the pandemic, the Fed enacted a very aggressive policy of printing money and dropping interest rates to near zero. The chart below shows the Federal Reserve balance sheet. You can see how it went from around $4 Trillion to around $9 Trillion in the past 2 years. This has led to a lot of liquidity in the system and has increased demand. Policymakers in DC will tell you it was necessary and effective to prevent worse economic problems in 2020 due to Covid.

As investors and spectators to this great monetary experiment, we need to be able to plan ahead and act in our own best financial interests. I have told many clients this is one of the hardest market environments I have ever experienced as I need to be able to protect my client’s wealth from inflation by working to yield returns greater than 8%. Most investors, even the more conservative ones have objectives of at least keeping up with inflation. However, with equities struggling to keep up, bonds falling apart, and even safe haven assets like gold and bitcoin not acting very well, it creates a real conundrum for everyone.

Supply and Demand

The Federal Reserve’s two policy tools of expanding/shrinking the balance sheet and setting interest rates are ways in which demand can be controlled. By increasing/decreasing liquidity, the Fed can work to smooth market booms and crashes. The Fed giveth and the Fed taketh away. So, the Fed is greatly capable of increasing and decreasing demand by allowing the right amount of liquidity in their opinion. However, the Fed cannot control supply. Right now, we are seeing massive supply chain disruption and shortages. No matter how much money is printed and how low interest rates go, the Fed cannot create food, energy, basic materials, or any consumer products. For the past 2 years, we have had record expansion of money while still dealing with the same amount of supply, and in the past 6 months to a year we have seen a massive decrease in supply. There are several major problems causing these shortages. Some are:

- War in Ukraine

- Zero Covid Policy in China

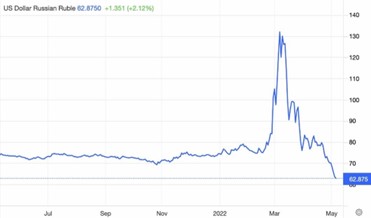

Currently, the War in Ukraine is a strategic war for resources. Ukraine is an extremely rich country in terms of commodities. They are a large exporter of industrial metals, basic materials, energy, and agriculture. A war in Ukraine means a disruption in economic activity and even less supply of these goods, amplifying our problems. Russia, is also an extremely commodity rich country and is a global supplier of energy. Due to the actions taken by Russia in their invasion of Ukraine, western allied nations (NATO), have enacted severe economic sanctions on both Russia and its citizens. These sanctions lead to the currency of Russia (Ruble) collapsing in March. However, as you will see on the chart below, Russia’s currency is now stronger than it was before the invasion.

This is because Russia is primarily a commodity exporting country and they have demanded that energy from Russia be purchased using their own currency.iii On top of that, they have fixed the price of a gram of gold to Ꝧ5000 Rubles.iv Decades of loose monetary policy from the Federal Reserve is creating doubt about our currency and financial system by foreign nations. Going forward, enemy countries are going to demand payments in commodities or seek payment in currencies backed by an asset like gold. Printing money to pay for imports has long been the American way and those days may be coming to an end.

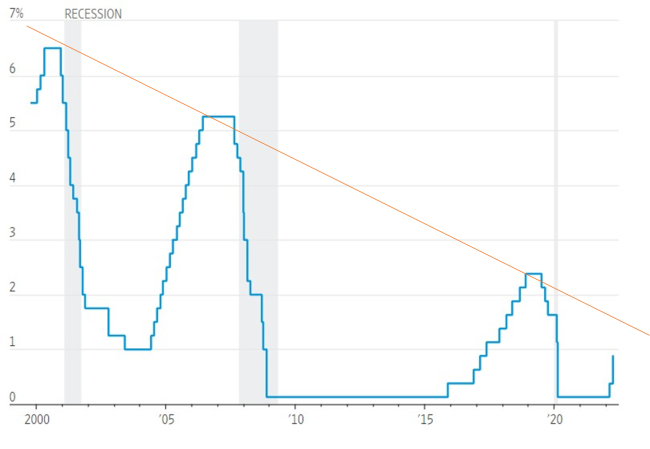

The policy decision of expanding the balance sheet (printing money) was used to help “fix” the Great Financial Crisis in 2008 as well. The chart above shows the first major increase. It was then followed by an even bigger expansion in 2020. “Money printing” or increasing balance sheet is used by the Federal Reserve to increase liquidity for banks and stave off recessions. While increasing the balance sheet has been helpful, it is only one of 2 major policy tools used by the Federal Reserve. The second major policy tool used by the Fed is setting the Federal Funds Rate. Looking at the chart below, you will see 20 some years of interest rate policy by the Federal Reserve. The Fed increases interest rates in bull markets to slow market expansion and prevent the economy from overheating and reduces interest rates to boost economic growth in downturns. Generally speaking, interest rates are highest before a recession (labeled in gray) and reduced by the Fed to get out of a recession. You will see that interest rates were highest in 1999/2000 before the dot come bubble, in 2007 before the great financial crisis, and in 2019 before the Covid Pandemic. On Wednesday May 5th, the Federal Reserve increased the Federal Funds Rate and is targeting somewhere between .75% and 1%.ii Some economists say the increase is necessary to slow inflation while others say it is a bad idea to raise rates when the economy is slowing. The Fed is trying to thread the needle by raising rates just enough to slow inflation while not raising them too fast to cause another recession. That is their tough choice.

Stuck Between a Rock and a Hard Place

So, what is the Fed to do? Inflation is running hot around 8% according to CPI and clearly needs to be reduced as it is hurting those living on fixed incomes and retirees. On the other hand, raising rates and reducing the balance sheet could spell trouble for US Equities, and that could potentially do more damage than inflation. I have been very skeptical that the Fed would actually raise rates or reduce the balance sheet at all. In my last few market commentaries, I have repeatedly stated my doubt. So far, I have been wrong as the Fed has begun raising rates, but right in that they are barely raising rates. If you look at the chart above, every time the Fed raises rates, they raise them less than the cycle before. Based on the trend of rate hikes in the past, I think we are near the peak of interest rates for this cycle. The Fed simply cannot raise them any higher without causing damage to the economy. While the Fed may talk a big game and act if they are serious about raising rates significantly to fight inflation, I don’t think they have the guts to actually do it.

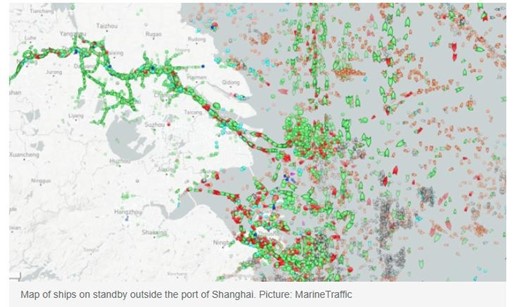

China

Russia’s neighbor and ally China is engaging in their own form of economic warfare, whether intentional or not, that is up for debate. China has a zero covid policy. They are shutting down some of the world’s most important manufacturing cities and ports to prevent the spread of the disease. The photo below shows cargo ships and oil tankers stranded at sea as strict Covid prevention measures prevent manufacturers and ports from efficiently creating and exporting products that are desperately needed throughout the world. Again, they may have altruistic intentions and truly believe they can stamp out Covid, I don’t know what the true objective is. However, it cannot be argued that the shortages are causing severe problems for the economies of western nations.

Crackup Boom?

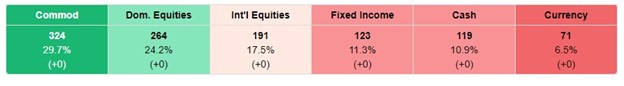

What we may be looking at here on a fundamental level is a crackup boom due to the loss of confidence in fiat currencies, primarily the US Dollar, Japanese Yen, and the Euro. A crack-up boom is an economic crisis that involves a recession in the real economy and a collapse of the monetary system due to continual credit expansion and resulting in unsustainable, rapid price increases. In the crackup boom, the central bank (Federal Reserve) attempts to sustain the boom indefinitely without regard to consequences, such as inflation and asset price bubbles. The problem comes when the central bank continuously pours more and more money, injecting it into the economy to give it a short-term boost, which eventually triggers a fundamental breakdown in the economy. We may be at that point now, and I theorize that in order to prevent any downturn in the economy, the Fed will continue to expand the supply of money and credit at an accelerating pace and avoid turning off the taps of new money until it is too late. As previously alluded, the Fed has 2 choices, they can continue to accelerate the expansion of the money supply and keep interest rates low in order to delay the recession. Or they can tighten with the risk of allowing some businesses to fail, asset prices to fall, and possibly create a recession or depression. The crack-up boom occurs when the central bank chooses and sticks with the first option. This could potentially lead to another bull market rally, our politicians are currently discussing student loan forgiveness, universal basic income, and many other forms of public welfare. This could lead to more consumer strength and fuel a final melt up in the stock market. How to Navigate Regardless of how the Fed respond, the best way to navigate an inflationary environment is by owning resources and commodities. In this situation the extra money will flow towards the real assets and companies that own/make/provide these assets will be the best investment options. Here at Carlson Asset Management, we have moved a lot of our client assets into commodity-based stocks. Even though they haven’t been completely immune to the overall negative sentiment, they have outperformed on a relative basis. We like and continue to like stocks in the areas of gold, silver, water, uranium, steel and agriculture. The overall massive increase in money supply leads us to believe that more money is going to continue chasing goods that are decreasing in supply. In this type of environment, it’s good to own physical things. Businesses, homes, cars, land, gold, bitcoin, food, and other things known as “stuff.”

Despite the turbulence, commodities, domestic equities, and international equities are still the best place to be on a relative strength basis. Historically, bonds and cash have offered safe alternatives when the equity markets are faltering. However, due to the weakening presence of the United States internationally, US Treasuries are having one of their worst years on records. It also bears repeating that cash is a guaranteed losing proposition in an inflationary market.

In Summary

These are indeed turbulent times we live in. But here’s the good news. If you look closely, nothing I’ve just explained to you is new, is it? We’ve been dealing with COVID since 2020; with inflation since 2021. In the last two years, we’ve lived through both a bear market and a recession and come out on the other side. We’ve been reading about supply chain issues for months; trade issues with China for years. The sources of today’s volatility are largely the same as yesterdays. Which means we know exactly how to deal with it. We know that patience and planning will not only help us avoid making major mistakes. They’ll also help position us for when the markets eventually rebound. We know that diversifying our holdings and sticking to our long-term strategy eliminates the need for relying on guesswork or shots in the dark. We know that doing all these things together will not only help us get through today. It’ll help us seize tomorrow, too. That’s why, despite the headlines, despite the gloomy forecasts, I remain confident in our direction and excited about the future. We have navigated volatility before, and we’ll do so again…all with a steady hand on the wheel.

respond, the best way to navigate an inflationary environment is by owning resources and commodities. In this situation the extra money will flow towards the real assets and companies that own/make/provide these assets will be the best investment options. Here at Carlson Asset Management, we have moved a lot of our client assets into commodity-based stocks. Even though they haven’t been completely immune to the overall negative sentiment, they have outperformed on a relative basis. We like and continue to like stocks in the areas of gold, silver, water, uranium, steel and agriculture. The overall massive increase in money supply leads us to believe that more money is going to continue chasing goods that are decreasing in supply. In this type of environment, it’s good to own physical things. Businesses, homes, cars, land, gold, bitcoin, food, and other things known as “stuff.”

As always, thank you for your continued trust in me and my team. If you ever have any questions or concerns about the markets, don’t hesitate to let us know!

i https://www.marketwatch.com/investing/index/djia

ii Latest Developments, The Wall Street Journal May 5, 2022 https://www.wsj.com/livecoverage/federal-reserve-meeting-inflation-rate-may-2022

iii https://foreignpolicy.com/2022/04/08/russia-ukraine-ruble-sanctions-ones-and-tooze/

iv https://www.russia-briefing.com/news/russia-positions-itself-to-move-the-ruble-to-a-gold-standard.html/