A Run on the Banks

“The fact that one small unelected entity can dictate the cost of capital for the entire world will eventually be seen as a medieval anachronism.” – Alex Gladstein

For me and for many of you over a certain age, the term “bank run” brings bank painful memories of the Great Financial Crisis of 2008 when Lehman Brothers and Bear Stearns collapsed. It was a time that most of us will never forget as there were legitimate fears that it was the end of the financial system. Similarly, for anyone who has studied history, the words “run on the bank” immediately trigger images of the early days of the Great Depression, or perhaps scenes from It’s a Wonderful Life. (Or Mary Poppins, if you prefer.) Dramatic moments now consigned to the waste bin of time. Surely not something that could happen in this day and age. But on Friday, March 10, all these words — bank failure, bank run – happened to the Silicon Valley Bank in northern California. It’s an event that has many investors, scarred by the memory of 2008, wondering if the same thing could happen to other banks. An event that has only added to the fearful mood currently pervading the markets.

Silvergate Capital (SI)

Starting last Thursday and over the weekend, we witnessed the failure, near failure, and “bailouts” of several financial institutions. The first bank to collapse happened last Wednesday on March 8th when Silvergate Capital (SI) announced that it was winding down operations and liquidate their assets. Silvergate Capital going under was not a surprise. They were one of the first banks to use cryptocurrency and had lent a lot of money to firms that had gone bankrupt such as FTX. Many on Wall Street were not terribly surprised to see Silvergate go bankrupt as their stock was down over 95% and they were struggling to meet their obligations. The real concern was whether or not there would be any contagion as no one knew if any other banks or financial institutions had exposure to Silvergate.

Silicon Valley Bank (SIBF)

The next day on Thursday March 9th, SVB Financial Group (SIBF) or Silicon Valley Bank started to rapidly drop in share price and closed the day down 60.41% after a bank run and rumors of insolvency. The bank did not trade on March 10th as the bank officially collapsed and went bankrupt. The bankruptcy was the largest bank failure since the financial crisis and the 2nd largest in US History. The reasons for Silicon Valley Bank’s Failure are a little more nuanced than Silvergate Capital. After the great tech boom over the last few years, Silicon Valley Bank was flush with cash and used much of that money to purchase “safe” long term treasury bonds. US Treasury Bonds are generally regarded as very safe. However, due to the rapid rise in interest rates this past year, the value of these Treasury Bonds had greatly depreciated in value. The bank was forced to sell these bonds at a loss in order to keep liquid. It wasn’t enough as the bank run was too much to overcome. Many of this bank’s clients are startups and tech companies in California. It should also be noted that over 89% of the bank’s client’s assets remaining as of Friday had over $250,000 with the bank. This is more than the FDIC insured amount and meant these individuals and companies would lose all their money in excess of $250,000. More on this later….

Signature Bank (SBNY)

The latest Bank to go down was Signature Bank. The bank was down on Thursday with rumors of insolvency and lacks of liquidity. The stock traded down with the rest of financial sector and was very volatile overnight heading into Friday March 10th. On that Friday, the stock traded on extremely high volume and was halted for trading many times as swung violently in both directions. Again, investors were selling stock and customers were withdrawing funds as fears that amounts over $250,000 would not be accessible in the event of a bankruptcy. On Sunday March 12th, Signature Bank was shut down by New York State Financial Regulators as the contagion from Silicon Valley overcame this financial institution as well.

Bailout

This weekend was one of the longest and most news filled weekends I can remember since being in the business. The abrupt failure of several banks with many more on the verge of failing made for a long tense weekend of uncertainty. Many panicked business owners, bank customers, and Silicon Valley startups were in panic mode as they had no idea whether they would have any money come Monday morning. I reference the dollar amount $250,000 earlier. That is the Federal Deposit Insurance Corporation (FDIC) insured amount that any person has at a bank.

On Sunday evening, Federal authorities took aggressive action to end the intense uncertainty and panic, agreeing to backstop all depositors for two failed lenders (Signature Bank and Silicon Valley Bank) and to prevent runs on any other financial institutions. The Treasury Department, Federal Reserve, and FDIC vowed that taxpayers would not bear losses from the moves to bolster the depositors at the two shuttered lenders. The agencies said depositors would have access to all their money on Monday.

In a stunning move, the Fed also announced that it would offer cash loans of up to a year for any bank putting up safe collateral, an action that in theory would allow banks to handle deposit withdrawals of any amount. The goal is to reassure people that they don’t need to take their money out at all.

“The U.S. banking system remains resilient and on a solid foundation, in large part due to reforms that were made after the financial crisis,” Treasury Secretary Janet Yellen, Fed Chair Jerome Powell and FDIC Chair Martin Gruenberg said in a statement. “Those reforms combined with today’s actions demonstrate our commitment to take the necessary steps to ensure that depositors’ savings remain safe.”

After news of bailouts broke, market futures and gold sharply rose and worries that Monday the 13th would be a black Monday were temporarily averted. Now that the Federal Government has intervened, many other banks that were on the verge of collapse are now getting backstopped by the Federal Government. It should be noted that this still may not be enough. First Republic Bank (FRC) and Western Alliance Bank (WAL) are both trading like they may go under as well.

Federal Reserve Policy

Higher interest rates have been pushing the market down since the beginning of 2022. After a terrible year in 2022, January of 2023 was great for the markets as it was beginning to feel like we had reached peak interest rates and peak inflation. The “soft landing” was but a sure thing. All the Fed had to do was keep interest rates where they were, with maybe a few small raises and things would be rosy from here. Unfortunately, that wasn’t the case as inflation roared back in February and the economy kept running hotter than the Federal Reserve would have liked. This led to fears that the Fed would raise rates even higher than previously anticipated. Last week, the market fell further following the comments made by Jerome Powell that he is going to raise rates and tighten monetary policy until inflation was down to their 2% target.

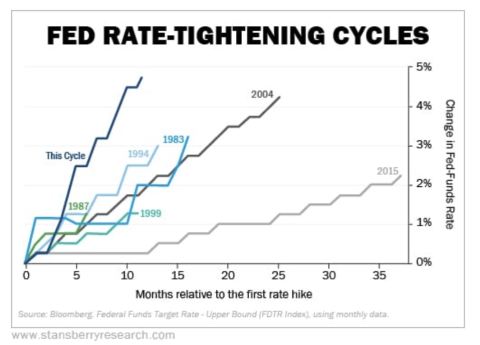

AS many of you who read my market commentaries know, I was skeptical of the Federal Reserve’s policy of raising interest rates from the beginning. I doubted they would be able to do it and I certainly never thought they would or could get to 5%. Too much money was printed in the last 3 years, the monetary base had gone parabolic, and our government and citizenry had added far too much debt in order to handle interest rates this high. Now that 3 US banks have collapsed, and several more failures are still possible despite emergency bailout, I would be willing to bet that Jerome Powell’s fight against inflation via raising interest rates is coming to an end. On Sunday March 12th, Goldman Sachs came out and said that in light of recent events, they no longer expect the Federal Reserve to raise the key interest rate at the March 23rd FOMC meeting with considerable uncertainty about that path after that. We went from the market expecting a ¼% raise, to Jerome Powell threating a ½% raise, to now possible no raises. Time will tell, but the credibility of the Federal Reserve will be under the microscope and any decision will be met with great doubt and uncertainty. The speed of this rate hike cycle has been faster and more dramatic than maybe any cycle ever before. It makes me wonder, what will break next?

Summary

As of this writing, the market is still on edge despite assurances from the government. Many regional banks are trading down on fears that the governments promises of providing financial backstop may not be enough. Remember, the government is bailing out the depositors, not the shareholders or bondholders of said banks. While customer assets will be protected, we could still see more banks go down unless more promises are provided by the Federal Government. This is still a very fluid situation but I wanted to make sure all my clients were aware of what was going on. Bailing out bank depositors is inflationary but bailing out banks is even more inflationary as money is printed in order to do so. Pausing interest rate increases to reduce financial risks is also inflationary. We may be reaching the point where the Fed and Treasury will be more tolerant of higher inflation in order to keep the financial markets operating smoothly. More to come…

Sincerely,

Bruce Carlson, CFP®

President

Carlson Asset Management

1Silvergate Capital will liquidate after crypto collapse wipes out bank (msn.com)

2Is Silicon Valley Bank getting a government bailout? Not in the 2008 sense (nbcnews.com)

3Signature Bank fails, closed by New York state regulators | Fortune

4Treasury, regulators unveil bank rescue plan to stem crisis - POLITICO