Russia-Ukraine Conflict, Federal Reserve Policy, and More Volatility

“The Dollar enjoyed great trust around the world. But for some reason it is being used as a political weapon, imposing restrictions. Many countries are turning away from the US Dollar as a reserve currency. US Dollar will collapse soon.” - Vladimir Putin, 2019

It’s all over the news and it’s having an impact on the markets. On Thursday, February 24, after months of tension and military buildup, Russia finally invaded Ukraine. It’s the first major war between European nations in decades, and brings significant humanitarian and economic ramifications for the entire world. Now, as you can imagine, the markets have reacted sharply to the news of invasion. In this message, I’m going to explain what effect this war is likely to have on both the global economy and on the markets. In particular, energy, inflation, and commodities. I’m a financial advisor, not a geopolitical expert or military strategist so I will focus on the economic impacts. Before continuing, though, I do want to say that my heart goes out to the Ukrainian and Russian people. They are nothing more than innocent bystanders as the people of Ukraine suffer through an invasion, and the people of Russia suffer extreme sanctions and financial ruin. I hope that peace prevails as soon as possible.

War in the 21st century is becoming more financial than it is kinetic. If you’re focused on kinetic action, you will miss the real war, cyber and financial. Most pundits and military analysts on TV are currently focused on what is happening in Ukraine. It is where the bombs are falling and casualties are taking place. However, the war is not only happening within the country of Ukraine, but taking place within the financial markets through sanctions and in cyber space through hacking other forms cyberwarfare. The west (NATO) has engaged in many different forms of economic warfare to repudiate and prevent Putin from advancing his objectives. Some of these sanctions include:

- Freezing assets and travel bans from wealthy to lower class Russians.

- Restricting Russia’s access to Europe’s and the United States financial markets.

- Halting construction of the undersea Nord Stream 2 pipeline, which was set to deliver natural gas to Germany and be a major source of new business for Russia.

- Barring Russian banks from raising money in the west or trading new debt in U.S. or European markets. i

The last point has to do with the west banning Russia from SWIFT (Society for Worldwide Interbank Financial Telecommunication). This is a system that services transfers between banks in international trade. By banning Russia from SWIFT, the west is essentially telling Russia they are not allowed to transact using US Dollars. This is why I chose the Vladimir Putin quote in the intro. Putin, along with China are looking to “dedollarize” international trade. In 2021, Russia completely ditched all US Dollars from its National Wealth Fund in favor of Euros, Chinese Yuan, and Gold. It was done in order to reduce the effect of future sanctions. Russia and China have also greatly reduced the amount of dollars in trade used between the two nations. It is becoming apparent that we are moving towards a bifurcated global economy where choice of currency is either pro NATO or pro Russia/China.

Energy

When it comes to the global economy, Russia and Ukraine are key players. For example, both together comprise 29% of the world’s wheat.ii Ukraine alone is one of the world’s top producers of corn, while Russia is Europe’s largest source of both oil and natural gas. Both countries also play a major role in producing minerals and metals, think copper, nickel, platinum, etc. These are not products the world can live without. The biggest issue however, is oil and natural gas. Western Europe heavily relies on Russia for natural gas. Europe is heavily dependent on Russian natural gas, which supplies about 40% of its needs. However, in response to Russian aggression in Ukraine, the German government decided to halt the certification of the new Nord Stream 2 gas pipeline, which runs from Russia to Germany beneath the Baltic Sea. This new project was supposed to double the capacity of natural gas currently being pumped from Russia to Germany. It is now dead.

Globally, demand for Russian energy isn't going away... Neither is all of the supply from Russia, at least not yet. But what is being taken out of the equation for now is a decent chunk of future supply, which is drying up for an undetermined amount of time... No one knows when the pipeline will come online, if ever. If this sounds like a recipe for higher energy prices, I agree. It might most directly influence prices in Europe. But energy is a global market. Russia is part of OPEC+ and what happens in one place regarding oil and gas plays out in other places, directly or indirectly. The possibility of Russia leveraging energy production and distribution in exchange for political gains are contributing to fears of tighter energy supply and more inflation worldwide.

Inflation

There’s no point beating around the bush: Consumer prices are already sky-high and are now likely to rise even higher. Due to the pandemic response by governments and the Federal Reserve, inflation has risen at a historic rate. New sanctions and supply-chain issues will only compound the problem. For that reason, it’s very possible we’ll see a jump in prices for the following goods and commodities:

- Gasoline. While oil prices and the price we pay at the pump aren’t the same, they are linked. Oil prices rose above $110 per barrel. iii

- Natural gas. As of this writing, prices are up 29% in Europe; we could see a similar rise.

- Travel costs. Pricier oil means pricier jet fuel, which means higher airfares for travelers.

- Food. As we’ve already covered, Russia and Ukraine are hugely important to the world’s supply of wheat, corn, and other staples. Russia is also a massive supplier of fertilizer to Europe. Food shortages could be coming.

The U.S. can release oil reserves to combat rising fuel prices, and Europe can turn to other places for natural gas and wheat. (Including the United States.) But while these measures can help, they’ll take time and can only blunt a rise in consumer prices, not stop it entirely.

Federal Reserve Policy and Interest Rates

Since the pandemic of 2020. The Federal Reserve has kept the Federal Funds Rate at record lows and has purchased bonds on a monthly basis to stimulate economic growth. Most of you have heard about this and I have written extensively on the topic in past writings. These monetary policies have been a very large, if not the primary driver of inflation we are seeing today. Due to the very high inflation we are currently facing, many experts expect the Federal Reserve will soon announce rate hikes to combat inflation. In light of the Russia Ukraine situation, interest rates will probably still go up, but might be less than previously thought. That’s good news for the stock market, at least in the short term, but it won’t help slow inflation as much. I have said in several letters in a row now that I don’t think the Federal Reserve will raise interest rates. If they do, I am guessing it will be nominal. That will be a tailwind for equities.

Commodities

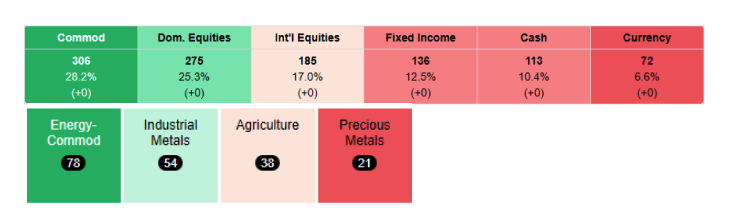

Recently, commodities have bumped domestic equities for the number 1 spot on the relative strength index provided by Dorsey Wright. Inflation of raw materials, energy in particular, has been a big driver and energy is the strongest performing sector of the commodity asset class. The Federal Reserve threatening to raise interest rates has been devastating to many tech stocks with high valuations and no profit. Going forward, we continue to like commodities and may find more value within the agricultural and precious metals asset classes. The market as a whole may experience volatility but there is always a bull market somewhere. In the 2000s, after the Dot Com Bubble, commodities had a fantastic decade while equities lagged with minimal returns and a lot of volatility. I am not saying that pattern will repeat itself, but there are other options and ways to navigate if that type of scenario were to play out.

The situation in Ukraine is changing every day, hour, and even minute. Headlines you read in the morning might be obsolete by afternoon. That’s why it makes no sense when investors panic, sell, or “cash out” just because of uncertainty. By the time they do, the situation they’re reacting to may have already passed! So, my advice over the coming weeks is to keep doing what we always do. Let’s keep our heads and hold to our long-term strategy. After all, we already know that it works!

I hope you found this message to be informative. Of course, please let me know if you have any questions or concerns about your portfolio. My team and I are here for you. We’ll keep monitoring the situation, and if anything changes, we’ll let you know immediately.

Sincerely yours,

Bruce Carlson, CFP®

President

Carlson Asset Management

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security.

i “What to know about economic sanctions and how they will affect Russia.” ABC News, February 25, 2002.

https://abcnews.go.com/International/economic-sanctions-affect-russia/story?id=83067637

ii “How a Russian invasion of Ukraine could hit supply chains,” CNBC, February 23, 2022.

https://www.cnbc.com/2022/02/23/impact-of-russia-ukraine-on-supply-chains-food-metals-commodities.html

iii “Russian Invasion sends oil prices above $100 a barrel” News Nation, February 24,2022

https://www.newsnationnow.com/business/your-money/russian-invasion-sends-oil-prices-above-100-a-barrel/