2026 Q1 Market Update

2026 Q1 Market Update

“The exis)ng fiat monetary order, the domes)c poli)cal order, and the interna)onal geopoli)cal

order are all breaking down, so we are at the brink of wars.” – Ray Dalio

As we progress through 2026, we wanted to provide you with an update on where the markets stand, our view of what is happening, and it how it pertains to our overall strategy. We will also review the economic and geopolitical factors shaping the markets and where we see opportunities. There are many encouraging trends in the markets, but also potential headwinds we think you should be aware of in the coming months. We'll review the precious metals sector and where we think they are heading next and discuss why equities now look comparatively undervalued against these metals. In our opinion, Metals have moved up as a reaction to government policies, and we feel the fundamental reasons that drove their prices up, are still in place. In recent weeks, we have seen some general weakness in the overall market, and concerns are starting to creep in about a potential recession. We see the potential for near-term consolidation or pullback, but feel it will be followed by more price action to the upside. Finally, with the tax deadline for 2025 filings nearing, we'll include a brief summary of tax changes under the One Big Beautiful Bill Act (OBBBA), covering updates for 2025 and 2026 to aid your planning.

U.S. Stock Market

All 3 major indexes, the Dow Jones Industrial Average, S&P 500, and the NASDAQ, are all currently trading within a few points of their all-time highs. Given the strength, you would

expect the sentiment to be more bullish. Ever since the “Liberation Day” market fiasco in April 2025, the market has been grinding steadily higher. More recently though, this upward move has started to plateau. For the last several months we have experienced sideways chop and have been flooded with a barrage of overwhelmingly negative headlines, not just in the market, but elsewhere which has given investors an extra layer of doubt and uncertainty.

Some potential reasons for the major market indexes to be trading near all-time highs have been the positive news on inflation and jobs. The January 2026 inflation numbers recently came in at 2.4%. This was the lowest inflation number we have seen since mid-2021 before inflation ran hot and peaked over 9%. This drawdown in inflation certainly gives policy makers at the Federal Reserve some relief and may even allow them an excuse to lower rates. The Jobs report came in for US Payrolls in January. 130,000 new jobs were added, which was above expectations and the unemployment rate dropped to 4.3%.ii The report was delayed due to the government shutdown but showed a resilient labor force. Some have questioned the inflation numbers, especially when we see commodities and food prices soaring higher. The government is telling us inflation is cooling, but our wallets may feel differently. The inflation report is heavily weighed February 2026 by housing and housing has recently cooled. So while the grocery store may s>ll seem like its

getting more expensive, the overall inflation rate has come down and that is what the market cares most about. As for the jobs report, that has also been ques>oned, and some have accused the bureau of labor statistics of “fluffing” the numbers. AI has been a menace to those seeking entry level and white-collar jobs and that trend will no doubt continue but for now, there are enough positions being filled to keep the unemployment rate low.

Federal Reserve

On May 15, 2026, Jerome Powell’s term as chairman of the Federal Reserve will be coming to an end.iii As you may recall, Powell was appointed by Trump in his first term in 2018 and

reappointed by Biden in 2022. His term has been a volatile one where he presided over the highest levels of inflation in 5 decades. The remedy to said inflation was the greatest monetary tightening since Fed Chair Volcker in the 80s. History will determine if Powell was as effective as Volcker, but the comparisons will none the less be made.

On January 30, 2026 Donald Trump appointed Jerome Powell’s successor in Kevin Warsh.iv Someone who is more likely to agree with the President on interest rates and overall monetary policy. In the past, Warsh has criticized the Fed for not lowering rates sooner. He also said on CNBC he wanted a "new accord" that would put central bank and fiscal goals in alignment...

“We need a new Treasury/Fed accord, like we did in 1951 and another period

where we built up our na)on's debt and we were stuck with a central bank that

was working at cross purposes with the Treasury. That's the state of things now...

If we have a new accord, then the... Fed chair and the Treasury secretary can

describe to markets plainly and with deliberation. This is our objective for the size

of the Fed's balance sheet."

In other words, lower rates are implied and expected. We find it hard to make a good bet on what Warsh's tenure will look like over a four-year term as Fed chair. For now, the market is expecting lower rates if he gets the job in May. But that's nothing new. Futures traders continue to give 70% odds on cuts by June.v We haven’t spent too much >me worrying about who the next Fed Chairman will be as we are of the belief that it doesn’t maper at this point. The fiscal policy in Washington is now a stronger driving force than monetary policy at the Fed. Even if we were to see a new administration of a different party in 2 years, the government will continue to overspend and engage in deficit spending.

Precious Metals

Gold and Silver have been the heroes of the market for the better part of the past 18 months. They have screamed to all-time highs and have performed far better than what we had

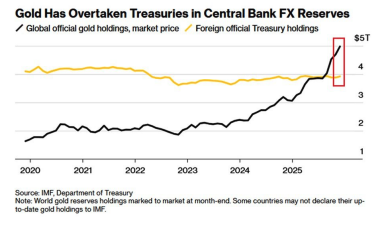

expected, despite already being bullish. The demand for gold and silver has been global and has been driven by countries and banks looking for safety in a world that is becoming multi-polar. The United States and US Treasuries no longer have the illusion of safety and the perceived value or quality they once had. In fact, Gold has now overtaken US Treasuries in Central Bank February 2026 foreign exchange reserves.vi Gold holdings have tripled since 2019 while Treasury holdings have remained flat. History tells us that Gold is money and global central banks prefer it to paper promises.

Our portfolio's higher-than-typical weighting in precious metals has been a key driver of returns over the past 18 months, providing both diversification and outperformance amid market uncertainties. Gold has surged dramatically, with prices reaching as high as $5,598 per ounce recently. It has now settled back to around $5,000 per ounce but it is up approximately 73% year-over-year and showing gains of over 178% over five years.vii Silver has been even more impressive, averaging around $80 per ounce, with a 137% year-over-year increase. So far in 2026, we have witnessed silver run as high as $121 per ounce, fueled by industrial demand and unresolved tariff uncertainties. Our overweight position in metals, typically 10-15% higher than peers, has contributed significantly to portfolio resilience. This allocation has not only preserved capital but generated alpha. We are pleased with the results and continue to view metals as a core hedge.

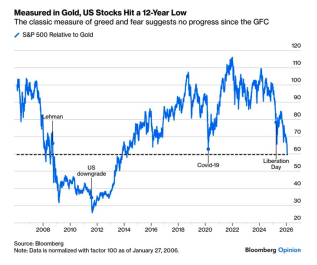

If you view gold as money, as we do, it would then be logical to price the stock market in gold instead of dollars. This exercise is fun as it gives you a different way of pricing assets and

comparing them on a relative strength basis. The results are rather striking as we see the market being as cheap now as it was during the beginning parts of the great financial crisis and covid era lows. This means that the stock market may be undervalued, gold may be overvalued or a mixture of both. Despite the high levels of the overall indexes, when accounted for inflation, we feel that more market upside may lie ahead.

That said, challenges are evident and warrant caution. Recently there have been several mini crashes, especially in the tech-heavy NASDAQ as fatigue may be settling in as the AI story may be starting to fizzle out. Earnings from tech giants continue to deliver, but many of the capital expenditures these companies have made in AI will require massive returns to justify the expenditures. It is something to keep an eye on. A major theme so far in 2026 has been the general broadening of the US stock market with many different sectors contributing to the upside. In January, the equal weight S&P 500 beat the traditional index by 1.9%, highlighting a solid showing from most companies.viii Large-cap stocks continue to display the best long-term strength, but the resurgence of small and mid-cap names is encouraging. The US Dollar continues its trend of declining strength, now down 12% from last year. The decline is driven partially by the so called “sell-America” trade in which investors are shying away from US assets as concerns grow over fiscal sustainability and monetary policy independence. In our view, this will increase the potential for a near-term correction, but the trend of long-term momentum in the markets is still intact.

Tax Summary: Key Changes for 2025 and 2026 W

With the April 15, 2026 deadline approaching for filing your 2025 taxes, it's an ideal time to review the sweeping changes under the OBBBA, signed into law on July 4, 2025. This act makes many Tax Cuts and Jobs Act (TCJA) provisions permanent while introducing new deductions and credits, potentially leading to larger refunds for millions. Note that several 2025 changes are retroactive to January 1, 2025, so they apply to your upcoming filing. For 2026, additional adjustments kick in.

- Permanent TCJA Extensions: The seven individual income tax brackets (10%, 12%, 22%, 24%, 32%, 35%, 37%) are now permanent, preven>ng scheduled increases ater 2025.

The larger standard deduction, elimination of personal exemptions, and limits on itemized deductions also persist. - Increased Standard Deduction: For 2025, an extra 5% inflation adjustment applies, with amounts at $15,750 for singles, $31,500 for joint filers, and $23,625 for heads of

household (made permanent post-2025). Seniors (65+) get an additional $6,000 deduction ($1,600 extra for blind or age-qualified, up to $3,200 for joint).

February 2026 - State and Local Tax (SALT) Deduction Cap: Raised to $40,000 for married and single filers ($20,000 for separate), subject to income phase-outs, up from $10,000 (temporary

through 2029, then adjusted). - New Deductions: No taxes on tips for qualifying service workers; no taxes on overtime pay for certain employees; auto loan interest deduction up to $10,000 for new U.S.-

made cars.

Most of our 1099’s have already been sent out but if you have any questions about your statements or tax documents, feel free to give us a call. In should also be noted that you have

until April 15 to make IRA contributions for the year 2025. Conclusion If the markets have felt “off” for the past few years, it may not be just you thinking it. The post-COVID market has broken the correlation between consumer sentiment and equity returns. Historically, sentiment wasted to the market as the market used to be a greater reflection of everyday life. Inflation has been wonderful for the market and awful for Main Street. The best way for you to protect yourself is to participate in the market and to own assets. The markets

may be viewed as “too high” but the current administration and the next Federal Reserve coalition will be putting their thumb on the scale to move markets higher. It helps solve the

problem of the national debt and it helps politicians win elections. If you know someone who could benefit from our services, we would love it if you sent them our way!

Sincerely,

Bruce and Brent Carlson, CFP®

Carlson Asset Management

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra IS or Kestra AS. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by Kestra IS or Kestra AS for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice mee<ng the par<cular investment needs of any investor. Neither the

informa<on presented nor any opinion expressed cons<tutes a solicita<on for the purchase or sale of any security.

ii https://www.cnbc.com/2026/02/11/jobs-report-january-2026-.html

iii https://www.federalreserve.gov/newsevents/pressreleases/other20220523e.htm

iv https://www.whitehouse.gov/articles/2026/01/wide-acclaim-for-president-trumps-nomination-of-kevinwarsh-as-fed-chair/

vi https://www.americanhartfordgold.com/gold-tops-global-reserves/

vii http://www.321gold.com/

viii https://dorseywright.nasdaq.com/research/hub/index